3rd Quarter Chinese Annuity

Cost Benchmarking

Most 3rd quarter annuity and renewal invoices are arriving the last week of May or the first week of June.

To simplify your 3rd quarter invoice review, we’ve compiled a benchmarking guide of Chinese maintenance costs.

Do you like stuff like this? Consider signing up for our free quarterly self-audit guide. The Q3 edition launches May 30th.

3rd Quarter Chinese

Invoicing Overview

Chinese annuity payments are made to the Chinese PTO in Yuan. Payment to the PTO can only be made through a local representative with an address in China.

When looking at an invoice line item for a Chinese annuity, your total cost will include the following:

The fee paid to the PTO for renewal

The fee paid to the local agent

The fee to convert your currency into Yuan

The service fee charged by your vendor or firm

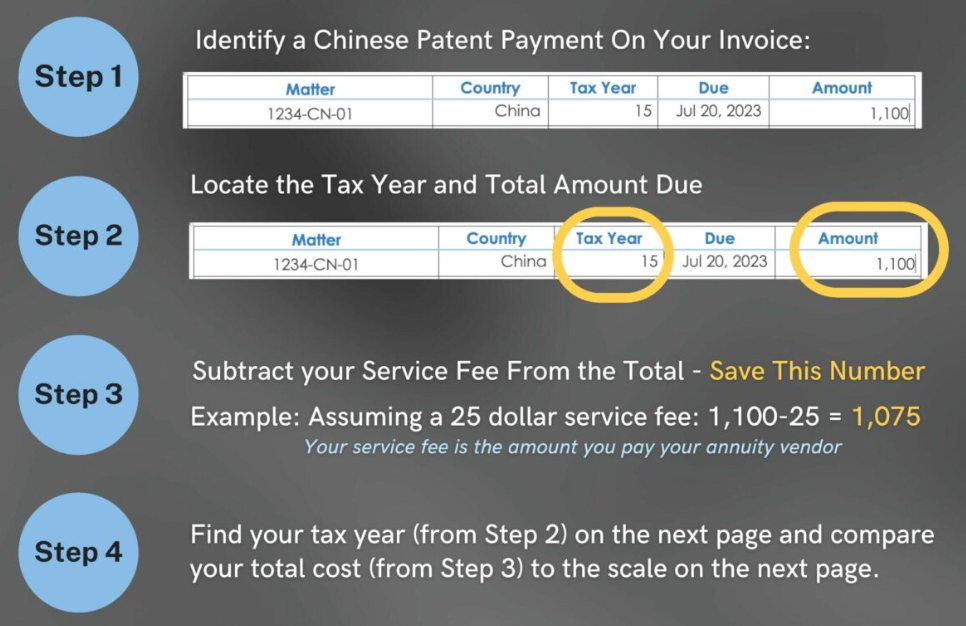

Vendors differ in what they show on invoices. Some will provide details; others will only give a total cost. Even if your vendor offers limited information, you can generally audit your charges as long as you know your service fee.

3rd Quarter Chinese

PTO Renewal Fees

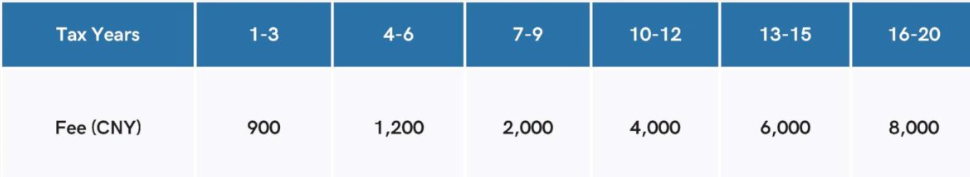

China has a graduated fee schedule, with renewal costs increasing as the patent ages. Most vendors provide the patent’s age (tax year) on their invoices.

If your invoice is missing the tax year, you can usually request it from your vendor or drop us a note, and we can calculate it based on your patent’s details.

Chinese Fees: https://english.cnipa.gov.cn/col/col3000/index.html

Year to Date

CNY/USD Currency Data

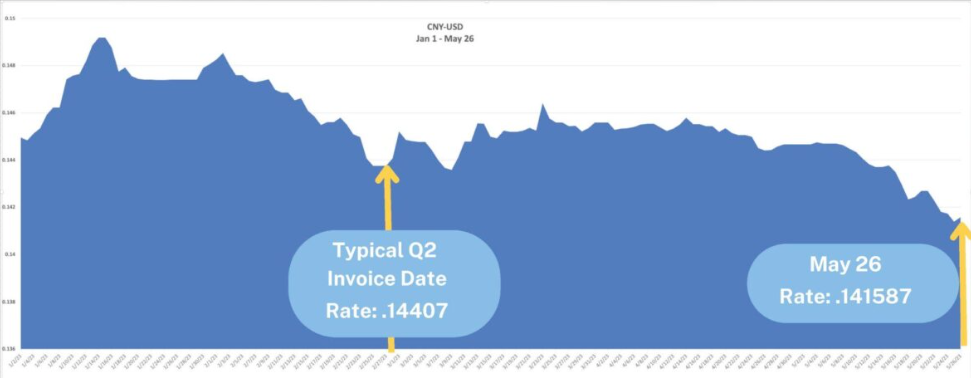

There’s been limited movement in CNY-USD rates since Q2. A Chinese year 20 annuity in Q3 should cost about 20 USD less than a comparable annuity in Q2 (all else being equal).

These are bank rates; annuity vendors will pay additional premiums to purchase currency or forward currency contracts.

Red Flag Alert: 🚩

Q3 charges that are noticeably higher than for comparable Q2 patents should be an area of concern and aren’t supported by currency changes.

Source: OANDA Historic Rates: https://www.oanda.com/

China Agent Fee

Benchmarks

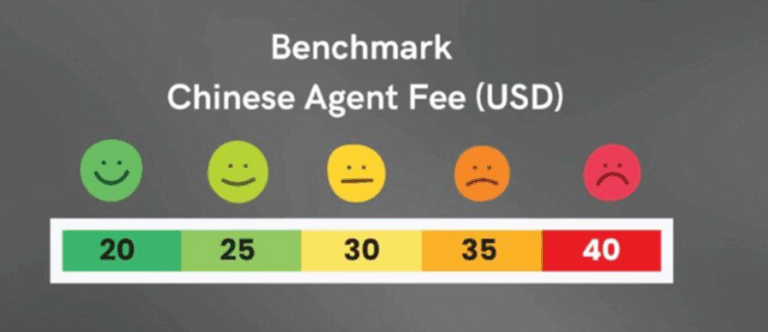

Annuity payment providers have long-standing relationships with Chinese agents and have negotiated volume discounts that are a fraction of the typical retail rate, which is 70 to 100+ USD).

There is substantial price pressure on agent fees, which have been trending downward for the last several years, a trend we expect to continue.

Given this, if your vendor charges you more than 20-25 dollars, you are overpaying compared to other vendors.

How to Audit

Chinese Annuity Charges

China 3rd Quarter Fees

Making It Real

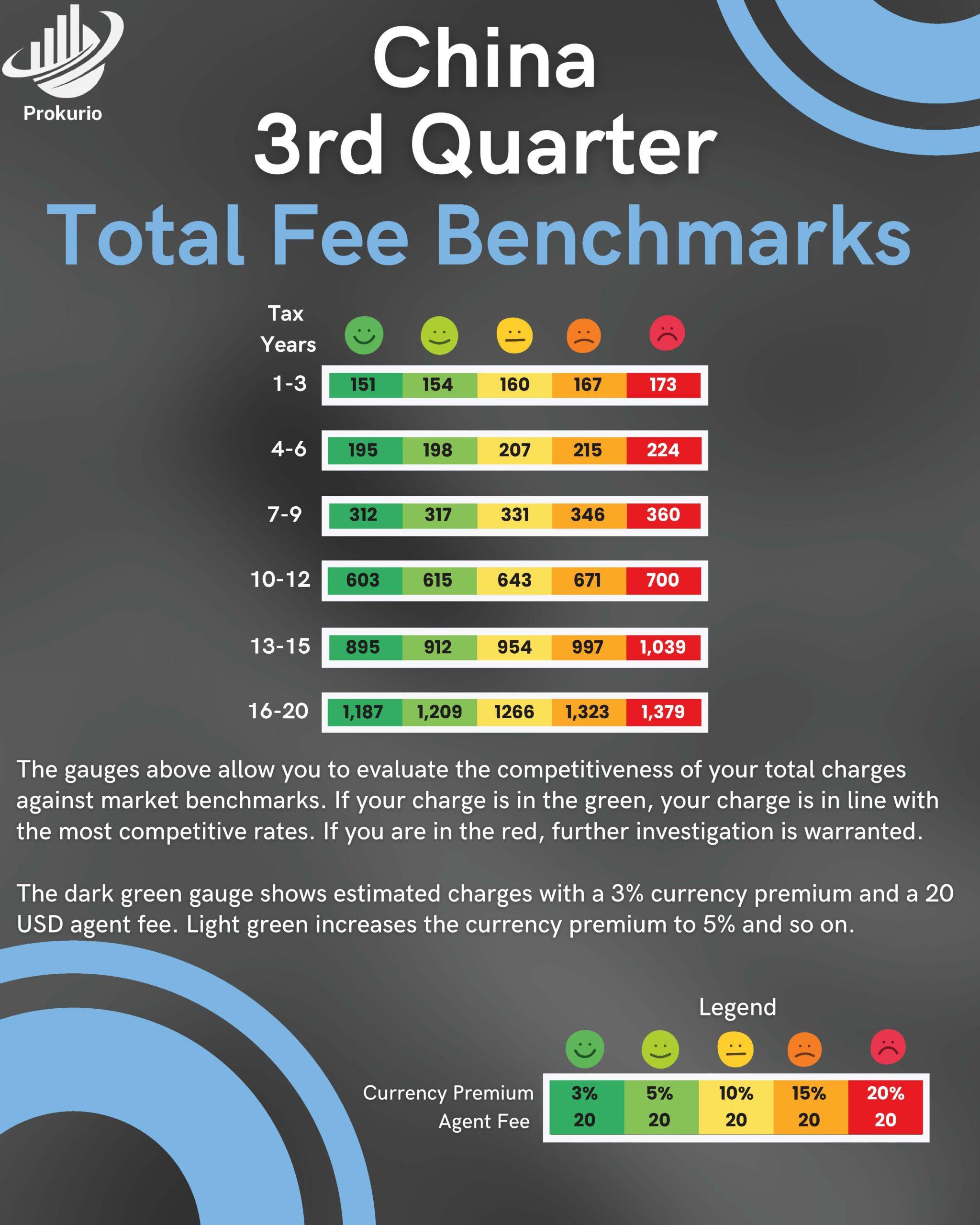

We built a hypothetical Portfolio with a mixture of patents of different ages to show the cost implications of different currency premiums.

A 20% currency premium costs approximately 14-15k more than a 3% premium for this portfolio mixture for this quarter.